Victims of the mortgage cost acquired recommendation from skilled accountants who had been being paid to position them into tax avoidance schemes.

Sky Information has seen proof of chartered accountants advising their purchasers to enter mortgage preparations, run by corporations that had been paying them a fee.

These schemes had been later focused by HMRC, and staff had been hit with large tax payments, generally lots of of hundreds of kilos.

Money blog: Value of a million homes rose 50% since COVID

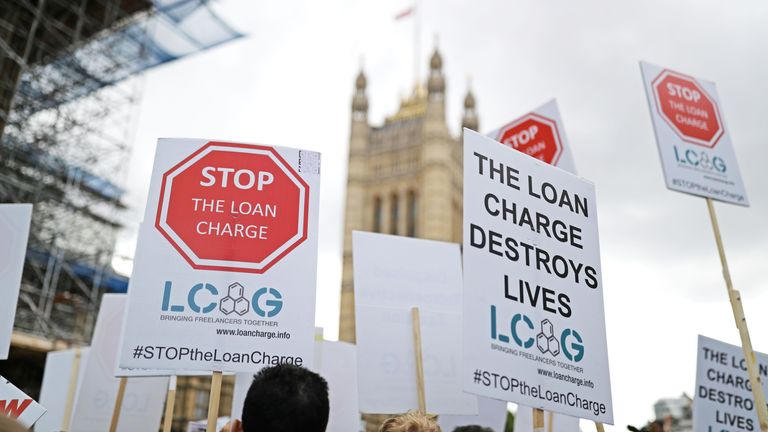

In some instances, the tax calls for have been crippling. It is a marketing campaign that has pushed folks to the brink of bankruptcy, devastated households and has been linked to 10 suicides.

MPs at the moment are calling for a public investigation into the position of accountants and different skilled our bodies within the proliferation of those schemes.

An unbiased evaluate of the mortgage cost is currently under way, however it’s restricted in its scope.

What’s the mortgage cost scandal?

It’s the newest revelation in a scandal that has brought about untold distress for tens of hundreds of individuals, who had been enrolled into tax avoidance schemes, usually towards their data.

They included contractors who had been urged to keep away from organising restricted corporations and to as an alternative obtain fee by the schemes, which had been meant to deal with their pay and taxes.

They labored by paying staff what had been technically loans, as an alternative of a wage. This allowed them to avoid paying earnings tax. What many assumed had been tax deductions on their payslips had been, in truth, charges going in direction of the promoters of the schemes.

Tax avoidance will not be unlawful, however HMRC has efficiently challenged tax avoidance schemes within the courts, and staff have subsequently been requested to pay the lacking tax. There is no such thing as a suggestion that these accountants broke the legislation.

Richard’s story

For Richard Clancey, HMRC’s dealing with of the mortgage cost looks like “state-sponsored bullying”.

After being provided a contract position in 2010, Mr Clancey, now a retired laptop providers skilled, contacted a chartered accountant in Kent to assist him arrange a restricted firm.

The accountant inspired him to enrol in a fee scheme as an alternative.

“He gave us an hour’s presentation on the advantages of the scheme and the way it labored,” Mr Clancey mentioned.

“This included how they might deal with all administration, pay all tax that was due, was IR35 and tax legislation compliant, had a decrease threat than utilizing a restricted firm, had been accredited by a tax QC and was at present utilized by a number of individuals who had been working for HMRC.

“The presentation was very elaborate and complex and I can not declare that I understood all of it, however I wished to make sure I used to be authorized and compliant, so I trusted the recommendation of a chartered accountant that use of this scheme was the suitable factor to do.”

Learn extra:

Rise in suicide attempts linked to HMRC crackdown

HMRC accused of ‘dangerous’ new tactics in tax crackdown

The accountant informed him that he was receiving an introductory charge, however not that he would obtain ongoing fee.

In 2014, Mr Clancey acquired an e mail from his accountant outlining that the earlier yr he had acquired £257 in fee. Nevertheless, he didn’t obtain statements for the earlier two years.

“Though you had been notified of this fee earlier than, we’re additionally required to declare the quantity of fee to you in accordance with the steerage of the Institute of Chartered Accountants of England and Wales,” the e-mail learn.

“This fee has not value you something,” it added.

The corporate’s former web site web page clearly acknowledged that it provided accountants fee, boasting that the charges had been raised.

At this level, Mr Clancey was already on the radar of HMRC.

In 2012, tax authorities wrote to him to elucidate that he had been in a tax avoidance scheme that “HMRC believes doesn’t work”. He was subsequently requested to pay greater than £100,000.

“Over the subsequent seven years, I acquired a number of penalties and threats from HMRC who mentioned I had been a tax avoider who ought to settle their money owed now or face worse penalties later,” he mentioned.

“There hasn’t been a single day after I have not been consumed by the frustration and anger of my scenario and the way it arose… Since my involvement with [the scheme] and the next hounding from HMRC and authorities, loads of that has modified. This state-sponsored bullying has brought about me to undergo some psychological well being points.

“My private stress ranges had been by the roof. I dreaded the subsequent brown envelope coming by the put up field with outrageous, unsubstantiated calls for. My poor spouse would apologise and burst into tears as she introduced these to me.”

HMRC mentioned it takes the wellbeing of all taxpayers significantly. “We’re dedicated to figuring out and supporting clients who want additional assist with their tax affairs and have made vital enhancements to this service over the previous couple of years.”

Like others in his place, Mr Clancey is annoyed by the blunt method of the tax authority and the shortage of accountability from different events.

“I’ve been more and more involved that my chartered accountant led me into the arms of a rip-off organisation,” he mentioned.

“HMRC continues to persecute victims.”

Authorities response

The federal government has now launched an unbiased evaluate into the mortgage cost, and HMRC is pausing its exercise till that evaluate is full – however its focus is on serving to folks to succeed in a settlement.

The evaluate is not going to take a look at the historic position of accountants, promoters and recruitment companies, although they propped up the schemes.

Politicians and campaigners have referred to as for a broader investigation.

Greg Smith, MP and co-chair of the Mortgage Cost and Taxpayer Equity APPG, mentioned: “It is clear that many chartered accountants had been instantly concerned within the promotion of mortgage schemes.

“Individuals trusted accountants and had the suitable to depend on this recommendation, and but, as an alternative, are dealing with life-ruining payments. There must be a correct investigation into this as a part of an unbiased inquiry into the mortgage cost scandal,” he mentioned.

“Both HMRC warned accountants to not suggest these schemes, during which case the accountants had been giving reckless and doubtlessly fraudulent recommendation; or HMRC did not inform accountants not to do that, during which case HMRC themselves had been significantly at fault.

“Both approach, it’s fairly unsuitable that the present authorities continues to solely pursue those that took and adopted skilled recommendation and never those that gave it, while making the most of doing so.”

The expertise has broken Mr Clancey’s religion within the sector. “I’ll by no means once more belief skilled monetary recommendation,” he mentioned.

“If the recommendation of a chartered accountant may cause this a lot injury with out culpability, then there’s something very unsuitable. It’s a failure on the a part of your entire tax business that accredited professionals can, by their recommendation, destroy the lives of the people that they advise.”

A spokesperson for the Institute of Chartered Accountants in England and Wales, an business physique, mentioned: “We count on chartered accountants to stick to the very best requirements in all of their work, together with tax.

“Strong guidelines for members performing tax work are contained in requirements which have been developed and strengthened to stop the involvement of members in aggressive tax avoidance.”

The organisation strengthened its requirements in 2017, after the mortgage cost laws was introduced, including that “members should not create, encourage or promote tax planning preparations or buildings that got down to obtain outcomes which might be opposite to the clear intention of parliament in enacting related laws and/or are extremely synthetic or extremely contrived and search to use shortcomings inside the related laws”.

Anybody feeling emotionally distressed or suicidal can name Samaritans for assistance on 116 123 or e mail jo@samaritans.org within the UK.

Within the US, name the Samaritans department in your space or 1 (800) 273-TALK.