What You Ought to Know:

– Gelt, the primary AI-native tax agency for high-earning professionals, has introduced it has raised $13M in Sequence A funding, bringing its whole funding to $21.2M.

– The funding spherical was led by international traders, together with Zvi Limon of the Rimon Group, Vintage Investment Partners, and TLV Partners. Concurrent with the launch, Yoram Tietz, former Managing Associate at EY, has been appointed Chairman of the Board.

Increasing Companies for the Complicated Healthcare Sector

With this new capital, Gelt is increasing its healthcare-focused providers by bringing AI-powered tax methods and specialised CPA groups to physicians and follow homeowners. Excessive-earning docs typically face the highest federal tax bracket (at present 37%), compounded by the monetary complexity of working a medical follow.

Gelt is constructing out service traces particular to healthcare, together with:

- 12 months-round optimization relatively than last-minute submitting scrambles.

- Tailor-made entity structuring (S-Corp, C-Corp, or LLC) to scale back tax burden and defend belongings.

- Retirement and wealth-building methods designed for follow homeowners.

- Devoted healthcare CPAs with expertise advising doctor teams and medical partnerships.

Delivering Measurable Worth

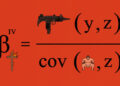

Gelt’s mannequin combines proprietary AI with licensed experience to ship clever, tailor-made tax methods. This fusion is designed to simplify complicated tax situations and assist physicians defend their revenue, plan for retirement, and construct long-term wealth.

In 2024–2025, Gelt partnered with a doctor group producing seven-figure revenues. By restructuring their entity and optimizing deductions, Gelt was in a position to determine greater than $450,000 in tax financial savings throughout the group. This end result not solely supplied monetary advantages but in addition freed physicians to spend much less time on monetary administration and extra time on sufferers.