The federal government has declined to rule out a “wealth tax” after former Labour chief Neil Kinnock referred to as for one to assist the UK’s dwindling funds.

Lord Kinnock, who was chief from 1983 to 1992, instructed Sky Information’ Sunday Morning With Trevor Phillips that imposing a 2% tax on belongings valued above £10 million would herald as much as £11 billion a yr.

Politics newest: Reeves’s tax turmoil deepens

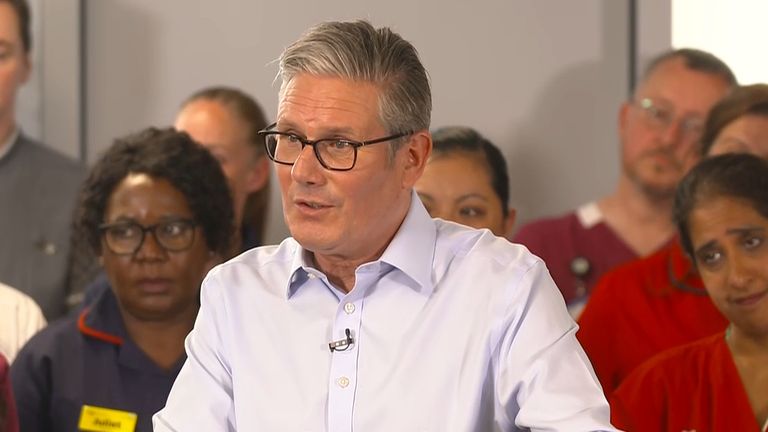

On Monday, Prime Minister Sir Keir Starmer’s spokesperson wouldn’t say if the federal government will or is not going to herald a particular tax for the wealthiest.

Requested a number of instances if the federal government will achieve this, he mentioned: “The federal government is dedicated to the wealthiest in society paying their share in tax.

“The prime minister has repeatedly mentioned these with the broadest shoulders ought to carry the most important burden.”

He added the federal government has closed loopholes for non-doms, positioned taxes on personal jets and mentioned the 1% wealthiest folks within the UK pay one third of taxes.

Chancellor Rachel Reeves earlier this yr insisted she wouldn’t impose a wealth tax in her autumn finances, one thing she additionally mentioned in 2023 forward of Labour profitable the election final yr.

Requested if her place has modified, Sir Keir’s spokesman referred again to her earlier feedback and mentioned: “The federal government place is what I’ve mentioned it’s.”

The day before today, Lord Kinnock instructed Sky Information: “It is not going to pay the payments, however that sort of levy does two issues.

“One is to safe assets, which is essential in revenues.

“However the second factor it does is to say to the nation, ‘we’re the federal government of fairness’.

“This can be a nation which may be very considerably fed up with the truth that no matter occurs on the earth, no matter occurs within the UK, the identical pursuits come out on high unscathed on a regular basis whereas all people else is paying extra for getting companies.

“Now, I believe {that a} gesture or a considerable gesture within the course of fairness equity would make an enormous distinction.”

The son of a coal miner, who turned a member of the Home of Lords in 2005, the Labour peer mentioned asset values have “gone by way of the roof” previously 20 years whereas economies and incomes have stagnated in actual phrases.

In reference to the chancellor refusing to alter her fiscal guidelines, he mentioned the federal government is giving the looks it’s “slowed down by their very own imposed limitations”, which he mentioned is “not truly the correct image”.

A wealth tax would assist the federal government get out of that scenario and can be backed by the “nice majority of most of the people”, he added.

His feedback got here after a bruising week for the prime minister, who needed to heavily water down a welfare bill meant to avoid wasting £5.5bn after dozens of Labour MPs threatened to vote towards it.

With these financial savings misplaced – and a earlier U-turn on cutting winter fuel payments additionally decreasing financial savings – the chancellor’s £9.9bn fiscal headroom has shortly dwindled.

In a touch of what might come, authorities minister Stephen Morgan instructed Wilfred Frost on Sky Information Breakfast: “I maintain pricey the Labour values of constructing certain people who have the broadest shoulders pay, pay extra tax.

“I believe that is completely proper.”

He added that the federal government has already put a tax on personal jets and on the earnings of vitality firms.