Because the clock ticked down in the direction of 12.01am Jap Normal Time on 12 March, Liam Bates saved refreshing his browser.

Over the previous weeks, Marcegaglia, the chrome steel firm whose lengthy merchandise division he headed up, had rushed to soften and ship as a lot metallic because it might from its furnaces in Sheffield throughout to the east coast of America, forward of the imposition of tariffs.

Stainless-steel

UK and US industrially interlocked

Of all of the kinds of metal, chrome steel – an alloy of iron and chrome, together with different parts like nickel, molybdenum and carbon – is among the many most necessary. In contrast to most different iron alloys, which may rust after they encounter oxygen, chrome steel has a passive movie that protects it from corrosion and may even self-heal. That makes it important not only for use in sinks and cutlery (the place most individuals will encounter it every day) however, arguably much more important, in surgical devices, heavy equipment and the pipes and ducts out of sight however important to holding civilisation working.

The trick of make chrome steel in giant portions was found right here in Sheffield by Harry Brearley, and whereas the laboratories he labored for shut down way back, the furnace at Marcegaglia, in an industrial park simply outdoors the town, can hint a steady thread again to him. This furnace was once owned by British Metal, the nationalised company chargeable for most of Britain’s metal manufacture till the times of privatisation.

Ever because the invention of chrome steel, Britain has melted, solid and exported huge portions of the stuff to America. For all that the US has a sizeable chrome steel sector, the 2 nations’ stainless sectors have nonetheless been industrially interlocked because the days of Henry Ford. You possibly can see it in the way in which Marcegaglia features.

It melts down scrap in its electrical arc furnace in Sheffield – an infinite cauldron whose electrodes create a storm of lightning that consumes the identical energy as a sizeable northern metropolis – and provides the related alloy elements to type a protracted, heavy metallic bar, a billet because it’s identified. That billet is then shipped throughout the Atlantic to the corporate’s different web site, the place the billets are processed into bars which can be then offered into the North American market. It’s a single financial organism, break up solely by an ocean.

However at the moment that ocean and that cross-country break up have turn into an infinite downside. The final time Donald Trump imposed tariffs on metal imports, again in 2018, so-called “intermediate” merchandise just like the billet made by Marcegaglia after which processed in America had been excluded from the duties. This time round, the preliminary tariff guidelines had no such exemptions. The upshot was that any metal arriving in American ports after 12.01am Jap Normal Time on 12 March – together with Marcegaglia’s half-finished stainless billets – would incur hefty 25% tariffs.

A race towards time

All of which was why Liam Bates had raced to get as a lot metal as attainable into the US earlier than that deadline. However as he refreshed his browser within the run-up to that deadline, he seen two straggling shipments, nonetheless caught on the Atlantic. The 2 ships, the Eva Marie and the Atlantic Star, had been, between them, carrying about $12m of metal they usually had been as a result of dock within the US on 10 or 11 March. In that case, they’d have averted having to pay these 25% tariffs. However now storms and squalls had been spreading throughout the North Atlantic. Would they stray into the ships’ path, disrupting transport?

If the cargo arrived late, it could obliterate any margin the corporate hoped to make on its metal. And since these bars had been destined for Marcegaglia’s personal plant, the corporate must pay all these prices itself (tariffs are technically paid by the importer). Someway, Bates had discovered himself helplessly witnessing an surprising collision of politics and climate – with profound business penalties.

Of all of the metallic gadgets Britain exports to the US, chrome steel is by far and away the most important class. And the overwhelming majority of that metal comes from the soften store at Marcegaglia. However the quandary dealing with Liam Bates, and people corporations he sells to within the US, helps illustrate the difficulties of financial policy-by-tariff.

Individuals will see value of most issues go up

The prevailing idea behind the White Home measures is that by elevating the value of all imported metals, it can encourage home producers to construct new manufacturing. It can assist the US to reindustrialise – or so says Donald Trump. And in the long term, which may effectively show proper. Already, metals producers are elevating cash, promising to restart outdated, mothballed smelters. In any case, in case your important abroad rivals have seen their costs rise by 25%, that is fairly a aggressive alternative.

The issue is: constructing industrial manufacturing takes time. Marcegaglia itself is planning to exchange its outdated furnace with a more recent mannequin, however the planning course of has already taken years; the development itself might be measured in months if not years too. In different phrases, even when every thing goes to plan, America may be very unlikely to exchange imported metal with home manufacturing inside the interval of Donald Trump’s time period as president.

Within the meantime, American shoppers will see the price of just about every thing going up. In any case, metal – ignored or dismissed because it typically is – is the only most necessary metallic substance on the earth. If one thing is not product of metal it is made in machines product of metal. And lifting a few of these metal costs by 25% will journey like an financial tidal wave by US provide chains.

UK flooded with low cost imported metal

The tidal wave is already washing again elsewhere too. With a lot metal now unable to get into the US at a good value, exporters are redeploying shipments elsewhere. Unexpectedly nations just like the UK are seeing a flood of low cost imported metal – excellent news within the quick run for shoppers, however disastrous for what’s left of Britain’s home trade.

Because the deadline approached and Bates nervously refreshed his dwell vessel monitoring map, catastrophe struck. The squalls throughout the Atlantic mounted and the Eva Marie and Atlantic Star slowed almost to a halt. By the point midnight struck and the tariffs got here into place, the 2 vessels had been nonetheless many miles off the US coast. They’d misplaced the race. The upshot was Marcegaglia must pay round $4m in tariffs – about £3m.

That an organization was struck with a considerably arbitrary price merely to go items from one in every of its factories to a different is perhaps among the many most egregious examples of the collateral financial harm wrought by commerce limitations, however it’s more likely to be the primary of many perverse episodes, with penalties all around the globe. For metal isn’t the one metallic to be hit with tariffs. If something, the drama is even better for one more metallic: aluminium.

Aluminium

The world’s largest manufacturing facility – hidden in Scotland

This is a riddle for you: what’s the largest manufacturing facility on the earth?

You are in all probability considering of huge, cavernous automobile manufacturing strains in Michigan, of shipyards in Korea or steelworks in China. However there is a sturdy case to be made that the world’s largest manufacturing facility is as a substitute to be discovered deep within the Highlands of Scotland.

Not that it seems something like a manufacturing facility. To the untrained eye, it seems, as a substitute, like heather, forests and effervescent burns of water trickling into lochs. However the 114,000 acres of estates in Lochaber and Badenoch – the third largest rural property in Scotland – play a vital function in serving to produce one of the crucial necessary substances on the earth.

The Fort William aluminium plant sits beneath the shadow of Ben Nevis, the tallest peak within the United Kingdom. As soon as upon a time, it was simply one in every of a constellation of smelters dotted round Scotland, that made this nation, all advised, one of many world’s largest aluminium producers.

For all that it is extremely prevalent within the earth’s crust, aluminium was once one of many world’s most treasured metals – a lot in order that nobody had even laid eyes on it till the nineteenth century. When he needed to impress his visitors, Napoleon III served them dinner not on gold plates however on aluminium.

A rare metallic

Why? As a result of aluminium may be very troublesome – even tougher than iron – to transform from the ores you discover within the floor into its metallic type. Burn iron ore sizzling sufficient, in the proper of furnace alongside the proper of charcoal or coal, and you ultimately smelt out a type of metallic. However aluminium wants a unique sort of pressure to be persuaded to loosen its bonds and type right into a pure metallic – the pressure of electrical energy.

So solely when the Corridor-Heroult course of, which lets you smelt aluminium by way of electrolysis of alumina (a processed model of the bauxite you get out of the bottom), was invented in 1886 did aluminium turn into a broadly accessible metallic. Few individuals speak today in regards to the Corridor-Heroult course of, but it surely was a breakthrough of earth-shattering proportions. Aluminium is a unprecedented metallic – sturdy however mild. And people qualities make it important in aeronautic deployments. No aluminium, no planes.

It’s no coincidence that the Wright Brothers’ airplane at Kitty Hawk had an engine made out of aluminium. Metal would have weighed the glider down an excessive amount of. And it is no coincidence that powered flight occurred shortly after aluminium turned broadly accessible. With out the Corridor-Heroult course of, the world would have been a really completely different place.

Whereas the method wasn’t dreamt up within the UK, British industrialists quickly embraced it, constructing smelters all around the nation. However the catch with aluminium is which you can’t smelt it with no huge and (that is necessary) very dependable provide of energy. Flip off the ability to these huge carbon electrodes inside an aluminium smelter and in a matter of hours the metallic at its base will solidify, successfully destroying it. Greater than almost another industrial course of, this isn’t one thing you’ll be able to simply swap off willy-nilly, which helps clarify why smelters aren’t usually depending on variable energy sources like wind and photo voltaic.

It additionally explains why, all through historical past, these crops have been seen as a number of the most necessary industrial places all through the world. The Fort William plant offered many of the aluminium utilized in Spitfires throughout WWII. It was repeatedly focused by the Luftwaffe – certainly there’s an outdated German bomb saved as a memento simply close to the generators that energy the cells right here.

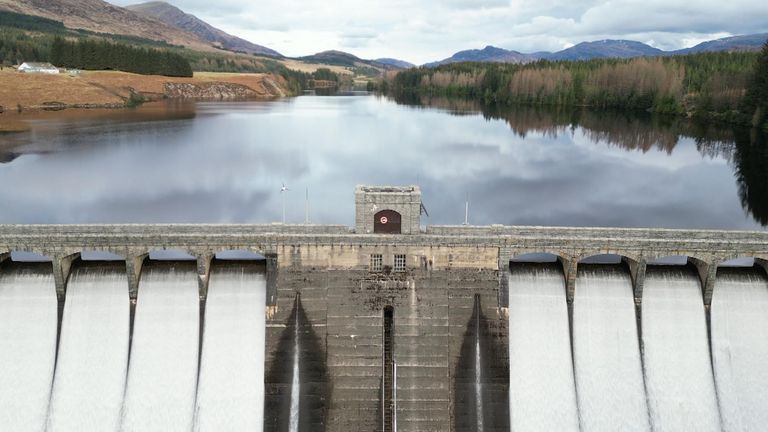

Among the world’s earliest smelters had been powered by hydroelectricity – most notably those which drew their energy from the Niagara Falls crops close to Buffalo, New York. However the Fort William plant was subtly however importantly completely different. These different hydro crops would usually piggyback off an enormous dam producing energy from an enormous river – comparable to those you discover within the US or Canada, or the fjords of Norway. However none of Britain’s rivers is sort of highly effective sufficient or with a dependable sufficient circulate to offer that sort of uninterrupted energy.

Radical design

So the designers of the Fort William plant did one thing radical. They purchased up huge stretches of the countryside round Ben Nevis (together with Ben Nevis itself). And inside that property, they constructed a sequence of dams to gather the rainwater trickling down from native watersheds. These dams weren’t there to generate energy for houses – they had been there to gather the water and channel it by a sequence of tunnels, working 16 miles by the hills and thru the flanks of Ben Nevis. Then the water, collected from these 114,000 acres, feeds 5 pipes working down the facet of the mountain which run into an infinite hydroelectric energy station.

There are various aluminium smelters around the globe and plenty of hydroelectric dams. However none are fairly like this one. The purpose being that with out the property, with out all these trickling streams and heather-covered watersheds, the plant right here merely would not operate. It’s all a part of a single ecosystem.

Lately the plant is linked to the nationwide grid, that means it additionally serves one other operate: balancing. This comes again to one of many dysfunctions of the grid: it does not have sufficient high-voltage strains connecting Scotland, with all its wind farms, and the south. So on windy days, when there’s an excessive amount of energy in Scotland, as a substitute of curbing these farms and losing the electrical energy, the plant can suck in additional energy from the Scottish part of the grid and go away its water the place it’s as a form of battery.

Competitors from China

The issue the plant has confronted is that today aluminium is a commodity metallic. And it is changing into tougher and tougher to compete with a budget metallic being exported from China. China dominates the worldwide provide of the metallic, largely as a result of its suppliers profit from low cost power and beneficiant authorities subsidies – neither of which can be found within the UK. Because the years have passed by, the employees at Fort William have watched as, one after the other, each different plant in Britain was shuttered. Rumours nonetheless abound that they could finally be subsequent.

And, a lot as for Marcegaglia down in Sheffield, the tariffs on aluminium will solely make life more durable for Alvance, the unit of Liberty Home – a part of Indian-born Sanjeev Gupta’s enterprise empire – that now owns the Fort William plant. Arguably, the affect may very well be even better. The final time Donald Trump imposed tariffs on aluminium again in 2018, the speed he selected was 10%. The distinction with the metal tariff degree (which was 25% then and now) mirrored the truth that the US imported way more aluminium than metal. Imposing extreme additional prices on it could, the White Home apprehensive, cripple the American aerospace and automobile companies depending on the metallic. No such concern this time round. The tariff is 25%.

Fairly how that can have an effect on the plant right here within the Scottish Highlands stays to be seen. In any case, Alvance itself does not promote something on to the US, sending its giant slabs of metallic to different companies in England which course of and roll them into sheets and specialised elements, a few of which find yourself within the US. Maybe, because the defence trade ratchets up within the coming years, extra of that aluminium might be utilized by home trade. However what’s to cease UK producers doing what they have been doing for years, and easily choosing the most cost effective metallic accessible, which normally comes from China? Both method, life for the final remaining aluminium plant within the UK is about to get tougher, not simpler.

However whereas the principle upshot of the commerce battle constructing throughout the Atlantic and the Pacific might be to make either side worse off – that, no less than, is the prediction from the Organisation for Financial Co-operation and Improvement – that does not imply there will not be some beneficiaries on this nation. For a small however necessary instance, let’s journey from the far north of Britain to its far south.

Tungsten

UK has one in every of its largest assets in world

Drive throughout Dartmoor, the windswept nationwide park within the coronary heart of Devon, and sometimes you come throughout the stays of an outdated tin mine. At Fox Tor you discover the stays of alluvial mining; there’s Golden Dagger Mine, which ran all the way in which to the Nineteen Thirties, in addition to the hole stone chimney of the pumping home at Wheal Betsy.

For a lot of the traditional period, tin – which when combined with copper creates the alloy bronze – was what we’d at the moment name a “essential mineral”, important for the manufacturing of the sturdy instruments and weapons of the Bronze Age. And for hundreds of years, the vast majority of Europe’s tin got here from Cornwall and Devon.

That, after all, is lengthy prior to now. However simply on the outskirts of Dartmoor is a web site that would – simply might – make this an necessary web site for essential minerals as soon as once more. For right here, beneath the soil of southwest England, is without doubt one of the world’s largest assets of tungsten.

Tungsten amongst few substances on everybody’s checklist

Tungsten is among the many twenty first century’s most necessary essential minerals. Practically each nation has a listing of those supplies – the sorts of issues they should make their most necessary merchandise – and the members of these lists fluctuate by area. However tungsten is without doubt one of the few substances that characteristic in everybody’s checklist. The toughest metallic in existence, with the best melting level, it’s important within the manufacturing of arduous metal instruments, weapons, armour and because the electrodes inside semiconductor circuits. If you’re making electronics you want tungsten. If you’re going to battle you want tungsten.

Maybe it is no coincidence that the principle heyday for this mine, which accommodates loads of tin in addition to tungsten, was within the First and Second World Wars. A lot because the Fort William plant offered aluminium for British Spitfires, Hemerdon offered the tungsten and tin wanted for the weapons Britain used to combat the Nazis. However ever since then, its historical past has been chequered, to say the least.

It went into hibernation for many years, a sleep damaged for less than a single day in the course of the Korean Conflict. Then, a couple of years in the past, traders tried to get it up and working once more. They constructed an unlimited processing plant and commenced to mine the metallic. However by 2019 the operation had run out of cash and imploded. All that was left was a good greater gap within the floor, a big tailings dam for waste and a hangar full of processing tools.

Partly, the explanation Hemerdon went belly-up that point was as a result of the corporate made the error miners usually make: they misjudged the kind of ore they had been anticipating to grind by, that means their processing plant was far much less environment friendly than it might have been. However a good greater problem got here again to one thing that can sound acquainted: they had been making an attempt to compete with China.

China dominates world tungsten manufacturing – much more so than for aluminium and metal. It basically controls the worldwide market and, simply as importantly, the tungsten value. Anybody making an attempt to promote tungsten is contending with Chinese language costs which may yo-yo for causes nobody can fully clarify. That makes it fiendishly troublesome to compete.

However in recent times, new traders have begun to place contemporary funds into the Hemerdon mine, hoping historical past won’t repeat itself and this time round it might probably exploit that giant ore useful resource. And there are no less than a few causes to consider (well-known final phrases in finance) that “this time is perhaps completely different”.

The primary is that, in retaliation towards Donald Trump’s latest metal tariffs, China has begun to place export limits on tungsten. How this can work in follow stays unclear (keep in mind that like most markets China controls, the way in which tungsten gross sales operate is nearly fully opaque) but when it encourages home consumers to search for native suppliers, that would assist the mine to search out consumers. In any case, in idea, it might produce a couple of thousand tonnes of the metallic every year, which might immediately leapfrog Britain to turn into the world’s second or third-biggest producer (albeit a great distance down from China).

Provides matter greater than ever

The second huge shift comes again to defence. With the world remilitarising, swiftly tungsten provides matter greater than ever. And since defence suppliers pay outsized consideration to the place metals come from, once more, which may enable a British tungsten mine to succeed the place predecessors have failed.

Add to this the truth that the mine itself is sort of able to be exploited and that the brand new house owners reckon they’ve ironed out the issues that beset their predecessors, and it is a compelling case. They assume they may very well be getting metallic out of the bottom as quickly as subsequent yr.

However these overarching challenges have not gone away. And nor has one other, greater downside dealing with the whole trade, not simply within the UK however – maybe much more so – within the US. How will you plan in a world the place you simply do not know what’s popping out of the White Home within the subsequent few days, not to mention the following few years?

Think about: think about you are a stainless-steel producer or an aluminium smelter within the US. These 25% tariffs imply swiftly in idea you may have a aggressive benefit over anybody transport metallic into the nation. Unexpectedly, there is a sturdy case to construct a smelter or a stainless-steel melting store. So that you get to work in search of backers.

Uncertainty creates challenges

However constructing a plant like this takes time. You could discover a web site, join it to high-voltage energy, and construct the services and all the required infrastructure. Greatest case state of affairs: it’d take a few years, however even that’s formidable. And as you ponder this and map out your plans, these backers will ask you an identical nagging query you have been asking your self: certain, the economics of an aluminium smelter may add up at the moment; however what if the president adjustments his thoughts tomorrow, or subsequent yr? What if these tariffs are pulled by the following president? Then, swiftly, the sums very a lot do not add up.

All of which is to say, uncertainty round tariffs is a problem not only for these corporations hoping to ship merchandise to America, however for American companies hoping to profit from this commerce battle. And keep in mind metals are solely the primary chapter of what may very well be a protracted saga, which finally ends up engulfing all corners of American commerce. These are unpredictable occasions, nevertheless you have a look at it.