At this time’s shoppers anticipate related and customized interactions as customary, and the very best finance companies can do that whereas retaining buyer loyalty.

As a way to obtain optimistic outcomes through the extra delicate levels of the shopper journey, comparable to collections and invoice reminders, it’s important to construct belief and supply assist to prospects on the proper place and time.

For monetary companies companies, delivering customized communications is quick turning into a aggressive necessity. In reality, a recent study by J.D. Power discovered that 78% of respondents would proceed utilizing their financial institution in the event that they obtained customized assist.

However there’s a disconnect to handle—solely 53% of traditional banks consider they’re really customer-centric in comparison with 80% of digital-native fintech organizations. And it’s a spot that may widen till companies empower their staff to create and ship personalized and compassionate experiences at scale.

On this weblog, we are going to discover what’s potential if you use Communications Platform as a Service (CPaaS) options to create customized buyer communication journeys to encourage well timed funds and assist prospects really feel supported fairly than chased.

Ship compassionate assist on any channel

Monetary companies companies face stress from more and more complicated rules such because the Shopper Credit score Act (CCA), GDPR, and PSD2. These rules require organizations to take measures to safeguard buyer information and lending rights. However companies should additionally take further care to guard prospects from monetary crises—particularly throughout occasions of financial uncertainty.

With 67% of Americans fearful about the price of dwelling, and the global cost living increasing by 8% in 2022 alone, thousands and thousands of shoppers around the globe are having to dip into financial savings or reduce on spending. And for a lot of others, that may imply taking out new strains of credit score or reassessing how and after they repay previous receivables.

To assist prospects by this tough time—and reduce the danger of income loss—it pays to create empathetic journeys utilizing automated alerts, reminders, and interactive two-way chats primarily based on contextual triggers. However dealing with these difficult buyer interactions is tough in the event you don’t have the newest instruments obtainable.

Many monetary companies companies are turning to easy-to-use cloud CPaaS options like Webex Connect to construct participating buyer journeys utilizing drag-and-drop communication movement builders. And by integrating with the channels your prospects use probably the most, these options may also help you direct interactions in order that they transfer seamlessly from one channel to a different.

Plus, through the use of Pure Language Processing (NLP), Pure Language Understanding (NLU), and AI-powered automation, you may create chatbots to rapidly fulfill buyer requests. You may as well join your chatbot to exterior methods to make sure they’ll pull in related buyer particulars, verify appointment availability, and different value-adding insights.

When carried out successfully, this protects invaluable agent time higher spent on extra delicate and financially profitable interactions and reduces working prices by eradicating the necessity to rent further groups to subject routine buyer interactions.

Ought to your service brokers must take over from a chatbot or contact a buyer, they’ll use buyer engagement purposes as a part of your CPaaS answer. This supplies a single dashboard for whole visibility over all previous and current interactions, together with buyer particulars, superior reporting, and multichannel queuing.

However what does this appear like in context? Right here’s how your CPaaS answer can enhance agent effectivity and nurture belief when dealing with delicate financial interactions.

Cut back threat and construct belief with ‘promise-to-pay’ alerts

Let’s face it, prospects might be intimidated by collections, and even caught off-guard by sudden requests for fee in the event that they haven’t been stored within the loop.

By sending automated ‘name heat up’ alerts forward of time, you may assist prospects higher put together for upcoming fee collections and consultations. Webex CPaaS Options additionally let your service brokers use NLP and NLU so prospects can affirm or reschedule the decision date by way of textual content chat, or speak to a reside agent in channel.

For instance, you might ship them a variation of the next message, “We’re going to name you quickly on [DATE]. Is that this time for you, or would you wish to reschedule? Reply YES to rearrange the decision, or AGENT to talk to a reside assistant.”

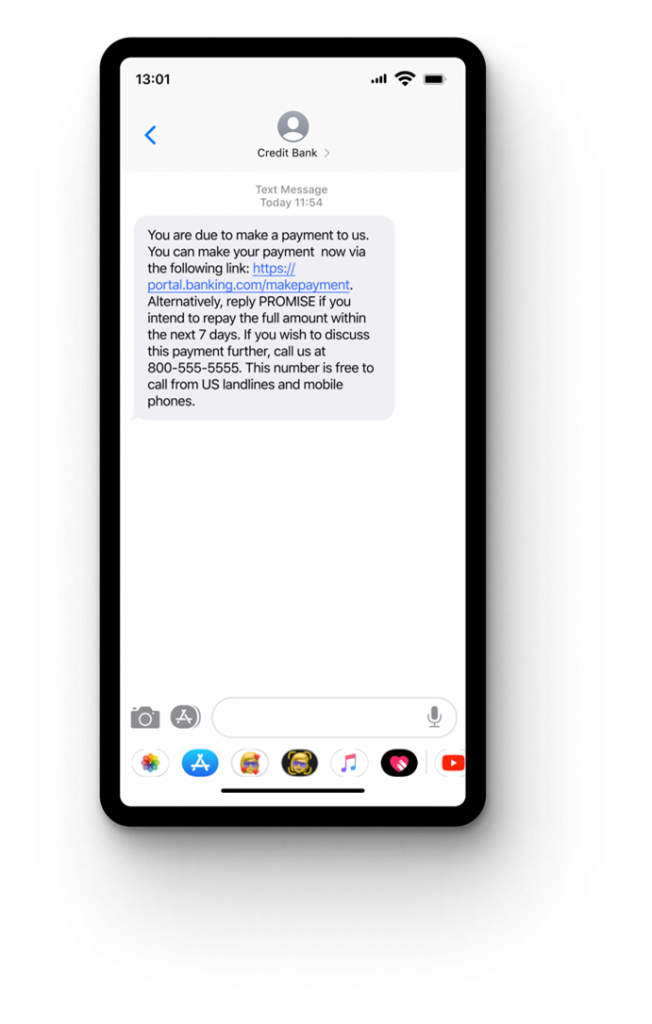

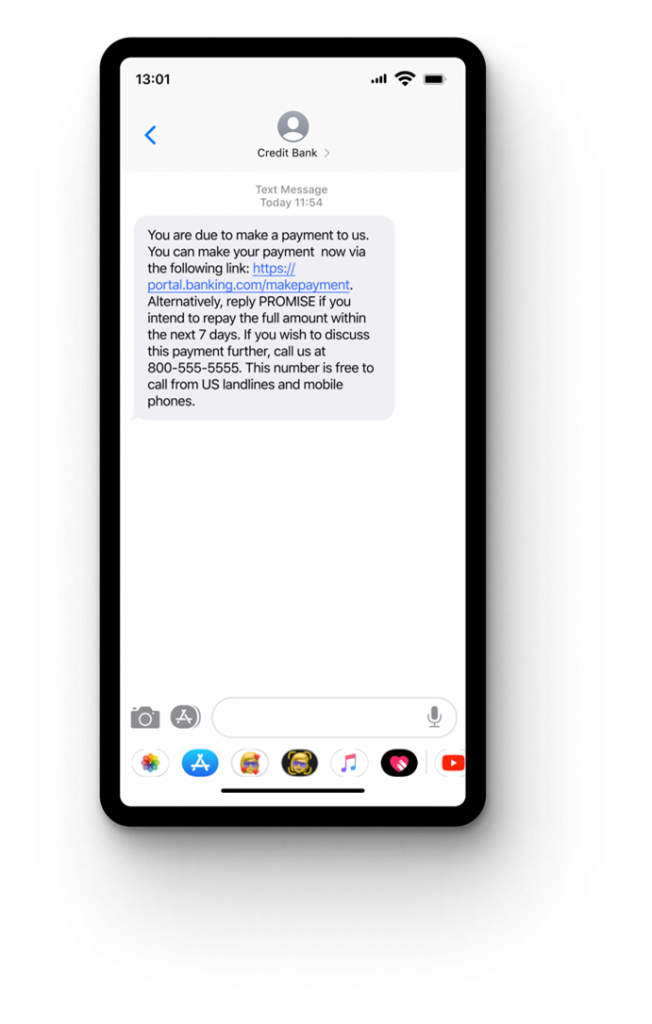

Likewise, our ‘promise-to-pay’ multichannel program can automate fee reminders and supply prospects with the choice to pay in-channel, affirm they intend to pay within the subsequent seven days, defer the fee, or contact a reside agent.

After all, nobody buyer is similar, and whereas some could reply instantly, others could miss a number of funds or ignore your alerts altogether. That’s why your CPaaS answer personalizes every interplay primarily based on buyer profile information, comparable to their most popular channel, previous engagements, and vulnerability. You may as well carry out A/B testing by experimenting with totally different language to see what will get the very best outcomes.

For instance, if a buyer misses a number of funds, it might ship them extra frequent reminders or supply entry to skilled monetary administration sources. What’s extra, Webex Join can combine with the newest in-channel fee options so prospects pays with out leaving the chat or direct them to their most popular fee methodology.

And it really works too. Our analysis reveals that 85% of respondents made a fee inside seven days after introducing an interactive SMS promise-to-pay scheme. And SMS name warm-up messages noticed first-time pick-up charges enhance from 20-30% to 50-60%.

Be a part of the finance leaders remodeling the shopper journey

It’s time to advertise flexibility and empower your staff with the instruments and insights they should orchestrate highly effective, empathetic buyer journeys.

And with our easy ‘promise-to-pay’ answer, you may enhance money movement, cut back threat, lower name heart prices, and nurture belief by clever automation and versatile buyer interactions.

To be taught extra, please discover our Webex CPaaS Solutions and monetary companies assist web page, or get in touch with one among our consultants.

Share: