Life science firms, significantly these closely invested in analysis and growth, typically face vital funding selections. Ought to they pursue an preliminary public providing (IPO) to gasoline their development, or is a strategic buyout from a bigger firm a extra appropriate path?

On this unique interview, Taylor Wirth, a companion at Barnes & Thornburg, affords his insights on evaluating market circumstances, assessing firm readiness, and weighing the professionals and cons of every funding possibility. He additionally highlights the significance of contemplating components corresponding to drug growth pipelines, FDA approval processes, monetary well being, and potential litigation when making this important choice.

How can life science firms assess the market receptiveness to their potential IPO, particularly contemplating the biotech/pharma sector?

Taylor Wirth, Companion at Barnes & Thornburg: Practitioners and market watchers had initially anticipated a extra strong IPO market this yr. Nonetheless, there have been fewer than 15 biotech IPOs in 2024 (in comparison with greater than 100 on the 2021 peak). The primary half of the yr was stronger for IPOs, however there have solely been 5 new choices since April 2024.

As well as, firms ought to think about the general state of the market. Is there extra important financial uncertainty or market volatility that will influence the quantity of IPOs and the valuation of your IPO? The early August 2024 market crash might have decreased valuations, making attracting curiosity from new buyers harder and dampening IPO hopes.

Why are R&D-intensive biotech/pharma firms more and more contemplating going public?

Taylor Wirth: IPOs enable firms, primarily rising and cash-intensive biotech firms, to:

- Generate substantial money shortly

- Enable preliminary backers a possibility to money in

- Improved entry to financing through follow-on choices and debt financing from public markets

- Elevated liquidity and valuation of inventory

- Enhanced public notion of the corporate (publicity, model recognition, repute)

- Provide workers inventory possibility plans and incentive plans to retain expertise

- Present reassurance to prospects and suppliers concerning monetary stability

What are some warning indicators that an organization won’t be able to go public simply but?

- Weak or inconclusive medical trial information

- Due diligence points, e.g., incapability to safety mental property rights

- Don’t meet market cap necessities or simply barely meet such necessities

- Inadequate money reserves for analysis and growth

You talked about you lately created a information for firms contemplating an IPO. Are you able to elaborate on some key factors firms ought to concentrate on within the present market local weather?

Taylor Wirth: The present IPO market could also be weaker than anticipated; nevertheless, firms needs to be conscious of getting ready for an providing effectively upfront. Corporations typically take a yr or two to organize for the IPO course of and begin appearing like a public firm internally and externally, so firms ready for improved market circumstances ought to plan now. A readiness evaluation helps to establish gaps and areas of enchancment on the trail to IPO:

- Capital Market Assessment makes use of an organization’s qualitative historical past and enterprise mannequin to develop an fairness story for buyers on its worth proposition and path towards worth creation.

- Monetary and Non-Monetary Facets –put together for disclosure of economic statements, steadiness sheets, revenue statements, money move statements, inner controls, historic accounting points and practices, and different stories to the SEC and guarantee compliance with Sarbanes-Oxley

- Company Governance –evaluation company data and conduct any vital housekeeping to adjust to SEC and inventory change necessities.

- Authorized and Tax Assessment –evaluation materials agreements for change in management provisions, deal with any litigation, and decide the right tax structuring.

You advise firms to interact with enterprise stakeholders to find out one of the best path. Are you able to stroll us by way of some key questions executives ought to ask their bankers concerning IPO vs. acquisition?

Taylor Wirth: Probably the most important consideration is whether or not an providing will in the end convey worth to the important thing stakeholders or whether or not it’s higher to promote to a bigger competitor. The fact is that the majority profitable start-ups will exit through acquisition. Do the prices of an providing outweigh a sale? What are your long-term targets, and does the corporate have the assets and personnel to take care of success as a public firm?

What inner components inside a life science firm needs to be evaluated to determine between an IPO and a buyout?

Taylor Wirth:

- Standing and timeline of trials

- Money move and burn

- Lengthy-term targets of founders and buyers

You talked about potential pending litigation impacting an IPO. Are you able to elaborate on how resolving mental property disputes can have an effect on an organization’s public providing technique?

Taylor Wirth: Disputes concerning possession of mental property have the potential to derail the method of going public. Defending an organization’s key expertise or drug is paramount to sustaining the worth of the corporate.

First, firms ought to establish all proprietary data used within the enterprise, together with all mental property. This course of must also verify the placement and safety protections of all such data.

Second, issuers are suggested to doc mental property assignments and confidentiality agreements with workers, consultants and others who’ve assisted within the growth of the corporate’s innovations.

Lastly, counsel can help in defending emblems, copyrights and patents, whether or not by appropriately submitting functions for innovations or defending in opposition to infringement claims.

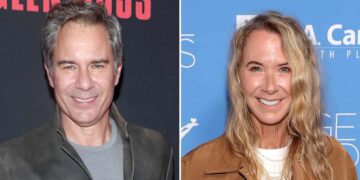

About Taylor Wirth

Taylor Wirth is a companion within the Company Division apply of Barnes & Thornburg. Taylor counsels public firms throughout numerous industries, together with retail and shopper merchandise, healthcare, and actual property funding trusts (REIT). Taylor has represented issuers in a wide range of securities transactions, together with preliminary public choices, secondary public choices, at-the-market (ATM) choices and personal investments in public fairness (PIPEs), and in different strategic transactions, together with mergers and acquisitions, divestitures, going non-public transactions and tender affords. He recurrently advises purchasers on company and securities issues, together with public firm disclosure, Part 16 and useful possession points, insider buying and selling, govt compensation, and environmental, social, and governance.