Hays, Capita, Petrofac. These are a few of Britain’s finest recognized corporations and massive gamers within the recruitment business.

Now, a Sky Information investigation has revealed how, over the course of twenty years, a few of Britain’s greatest recruitment corporations have been linked to large-scale tax avoidance when putting employees into jobs, together with authorities roles in Whitehall.

Many of those employees, usually company employees and contractors, have been paid by third-party umbrella corporations that promised to care for taxes however have been working tax avoidance schemes.

They labored by paying employees what have been technically loans, as an alternative of a wage. This allowed them to avoid paying revenue tax.

Typically the umbrellas have been really helpful by recruiters, though there is no such thing as a suggestion the recruiters knew these third-parties have been working tax avoidance schemes.

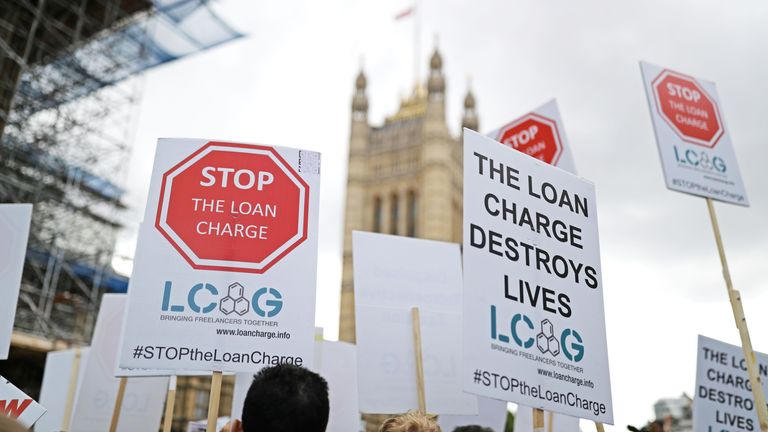

It’s the newest revelation in a scandal that has triggered untold distress for tens of 1000’s of individuals, who signed up with umbrella corporations and have been enrolled in tax avoidance schemes, considering they have been above board.

Many really feel let down by the recruitment companies who offered data linking them to the umbrella corporations. They weren’t legally accountable for gathering the tax, as they didn’t run the payroll.

However the authorities is now strengthening the regulation to make them accountable for the tax collected by umbrella companies on behalf of the employees they provide.

Tax avoidance is authorized however HMRC has efficiently challenged tax avoidance schemes within the courts and employees have subsequently requested to pay the lacking tax.

In some instances, the tax calls for have been crippling. It is a marketing campaign that has pushed folks to the brink of chapter, devastated households and has been linked to 10 suicides.

Manuel’s story

Manuel Bernal didn’t doubt his working association after taking up a piping supervisor job by Atlantic Resourcing, the recruitment arm of the power big Petrofac. In 2006, he was positioned on an EDF plant within the Shetlands.

He obtained a contract between Atlantic Resourcing and an umbrella firm, which managed his pay.

Weeks after he began working, he says he was pushed into an association with a special firm, which took over the funds. Tons of of individuals have been engaged on the positioning and “all people on the administration aspect was on that scheme”, he mentioned.

Mr Bernal was assured that the whole lot was above board. He didn’t know that he was in a tax avoidance scheme.

The corporate was paying him a mortgage as an alternative of a wage, through a belief, so prevented revenue tax and Nationwide Insurance coverage.

Nonetheless, HMRC quickly caught on and demanded he pay the lacking tax for what it now deemed disguised remuneration.

“On the time, I used to be in two minds [whether] to pay or to not pay… On the time I could not pay. I used to be in need of cash as a result of I had most cancers and I could not work… I assumed, ‘why ought to they not pay any cash?'” mentioned Mr Bernal.

Tax avoidance is the exploitation of authorized loopholes to pay much less tax. It’s authorized. It isn’t the identical as tax evasion, which entails not paying or underpaying taxes and is unlawful.

The scheme Mr Bernal was in, like different tax avoidance schemes, stretched the boundaries of the regulation.

Years later, HMRC efficiently challenged the lawfulness of mortgage schemes within the courts. Employees paid the value. Regardless of how they entered the schemes, they have been deemed accountable for their very own tax affairs.

In a press release, Petrofac mentioned: “Like another firm, we aren’t concerned in, or accountable for, the administration of taxes for self-employed restricted firm contractors.”

The corporate stopped utilizing umbrella companies in 2016 after an inside overview.

Six-figure calls for

Manuel bought off comparatively frivolously. Having solely labored on the website for just a few months, his invoice got here in at £4,000, however others are dealing with six-figure calls for. HMRC has pursued round 50,000 folks.

Schemes like these proliferated from the early 2000s.

On the time using umbrella corporations was turning into standard as employees have been apprehensive about falling foul of latest guidelines – initially designed by Gordon Brown – that clamped down on contractors working as restricted corporations.

Umbrella corporations would handle the payroll so that companies might keep away from bringing employees onto their direct payroll. Others requested employees, like Manuel, to declare as self-employed, whereas persevering with to distribute their pay.

Many umbrellas paid PAYE to the exchequer, however tax avoidance corporations additionally entered the market.

Employees assumed their tax was being paid, however the schemes have been pocketing deductions as an alternative of passing them on to the exchequer.

The Treasury grew to become alert to the dimensions of the lacking tax income and sought to recoup it – not from the businesses however from the people.

These schemes have been deemed disguised remuneration and, in his 2016 price range, former chancellor George Osborne introduced within the mortgage cost.

In its authentic type, the mortgage cost calculated the tax on as much as 20 years of revenue as if it was earned in a single monetary 12 months – 2018/19. The ensuing sums triggered appreciable monetary misery.

Mr Bernal mentioned: “(HMRC) saved sending letters once I was in hospital and my spouse needed to take care of it. Ultimately, I despatched in a health care provider’s report they usually stopped.”

‘I trusted them’

Mortgage schemes grew to become enmeshed within the recruitment provide chain.

Many recruiters weren’t conscious the umbrella corporations they have been working with have been tax avoidance schemes. Nonetheless, the power of their suggestions usually gave employees confidence.

John (not his actual identify), an IT employee, felt he was in secure palms when he used an umbrella firm that was on an permitted record given to him by the recruiter Hays in 2010.

“I assumed Hays is without doubt one of the greatest recruitment corporations within the nation,” he mentioned. “They’re saying they’re okay, so I began utilizing them.”

Hays mentioned it “engages solely with umbrella corporations that appropriately meet authorized and monetary obligations… We conduct thorough due diligence… we suggest (contractors) additionally do their due diligence”.

HMRC has beforehand warned recruitment companies they face penalties in the event that they refer folks to non-compliant umbrella corporations however it has not confirmed whether or not fines have ever been levied.

In the meantime, new tax avoidance promoters proceed to enter the market.

A latest authorities report concluded there could possibly be “70 to 80 non-compliant umbrella corporations concerned within the operation of disguised remuneration avoidance schemes”.

Crackdown

The federal government is now making an attempt to wash up the business. It plans to carry recruitment corporations legally accountable for PAYE, reasonably than umbrella corporations.

Sky Information understands that the Treasury will immediately unveil a bundle of reforms it’s going to seek the advice of on as a part of a crackdown on tax avoidance schemes.

Nonetheless, this provides little respite to those that have already fallen sufferer to those schemes.

Whereas in opposition, key Labour Get together figures railed towards what they described as mis-selling and promised they’d overview the coverage.

The federal government has now launched an impartial overview into the mortgage cost – and HMRC is pausing its exercise till that overview is full – however its focus is on serving to folks to succeed in a settlement. The overview won’t have a look at the historic function of promoters and recruitment companies.

That could be a bitter tablet to swallow for these affected by the mortgage cost, significantly as a lot of them have been working for the federal government itself.

‘I despatched them a suicide observe’

Peter (not his actual identify) labored on the Division for Enterprise, Innovation and Abilities as a undertaking supervisor for the regional progress fund, a job he was recruited into in 2012 by the company Capita.

He mentioned Capita really helpful he use an umbrella association, which he was instructed was above board.

“I am actually indignant. [Capita] gave me confidence. They’re the important thing company for central authorities work… If Capita say one thing to you you then consider it is appropriate. You must belief what you are instructed.”

Capita mentioned: “We’ve strict insurance policies in place to make sure each Capita and our suppliers adjust to related regulation, insurance policies and procedures. Given this was over 12 years in the past, we would not have the main points to have the ability to touch upon this explicit matter.”

Sky Information has spoken to different Whitehall employees who’ve additionally been affected.

Learn extra:

Thousands targeted by tax-collecting scheme linked to suicides

HMRC accused of ‘sinister’ tactics in crackdown

After the mortgage cost got here into pressure, Peter was inundated with letters from HMRC. It grew to become overwhelming and in 2019 he tried to take his personal life.

“I despatched them [HMRC] a suicide observe as a result of I used to be simply fed up with all of this,” he mentioned. “I have been on anti-depressants. I reside in denial. I drink alcohol generally fairly a bit.”

HMRC mentioned it takes the wellbeing of taxpayers severely and believes it has made vital enhancements to its help providers lately.

The federal government division Peter labored for has since been long-established into the Division for Enterprise and Commerce.

It mentioned it was unable to touch upon the earlier division’s preparations with Capita however mentioned the federal government was cracking down on non-compliant umbrella corporations.

Anybody feeling emotionally distressed or suicidal can name Samaritans for assistance on 116 123 or e mail jo@samaritans.org within the UK. Within the US, name the Samaritans department in your space or 1 (800) 273-TALK